Avoid profit-draining cash flow mistakes through tax refunds.

One of the most impactful profit draining mistakes to avoid is not paying close attention to cash flow (Business Advice, 2017), and one of the first steps to tackling cash flow is indeed to identify where your business is losing profit.

In the EU, almost €5.47 billion in cross-border tax entitlements remain unclaimed every year, according to the European Commission (InvestmentEurope, 2015). Even if your company is making claims for refunds, utilizing the services of an experienced partner like NIKOSAX will mean that your firm is able to recover every penny in a timely fashion.

NIKOSAX has for its 50 years of existence, been in constant communication with EU tax authorities in their native languages. The result is that NIKOSAX is able to remove all the impediments facing cross-border tax recovery such as the underlisted.

The challenges of cross-border tax refunds.

- Lack of awareness of the expenses on which refunds can be reclaimed (see our services to learn more). Companies also have to beware of the fact that some services are accepted for refund in one country, but not in another. This means that companies cannot simply group all foreign invoices together into one VAT or Excise duty refund request.

- The process involves a mix of languages and currencies while dealing with foreign tax authorities which adds to the complexity. Apart from the requirement to communicate in the native languages of tax authorities, all claim substantiating documents must also be translated accordingly and several currency conversions must be concurrently managed.

- Refund laws also vary from country to country and are constantly changed. So companies have to divert their attention from their core business to ensure they are up to date.

Seeing these challenges, most companies refrain from pursuing their cross-border tax refunds because it means increased administrative burden and operational overhead costs. But €5.47 billion unclaimed entitlements per year is a clear indication that businesses lose a significant chunk of their profits overtime. That is why NIKOSAX exists - to make the collection of cross-border tax refunds smooth and worthwhile.

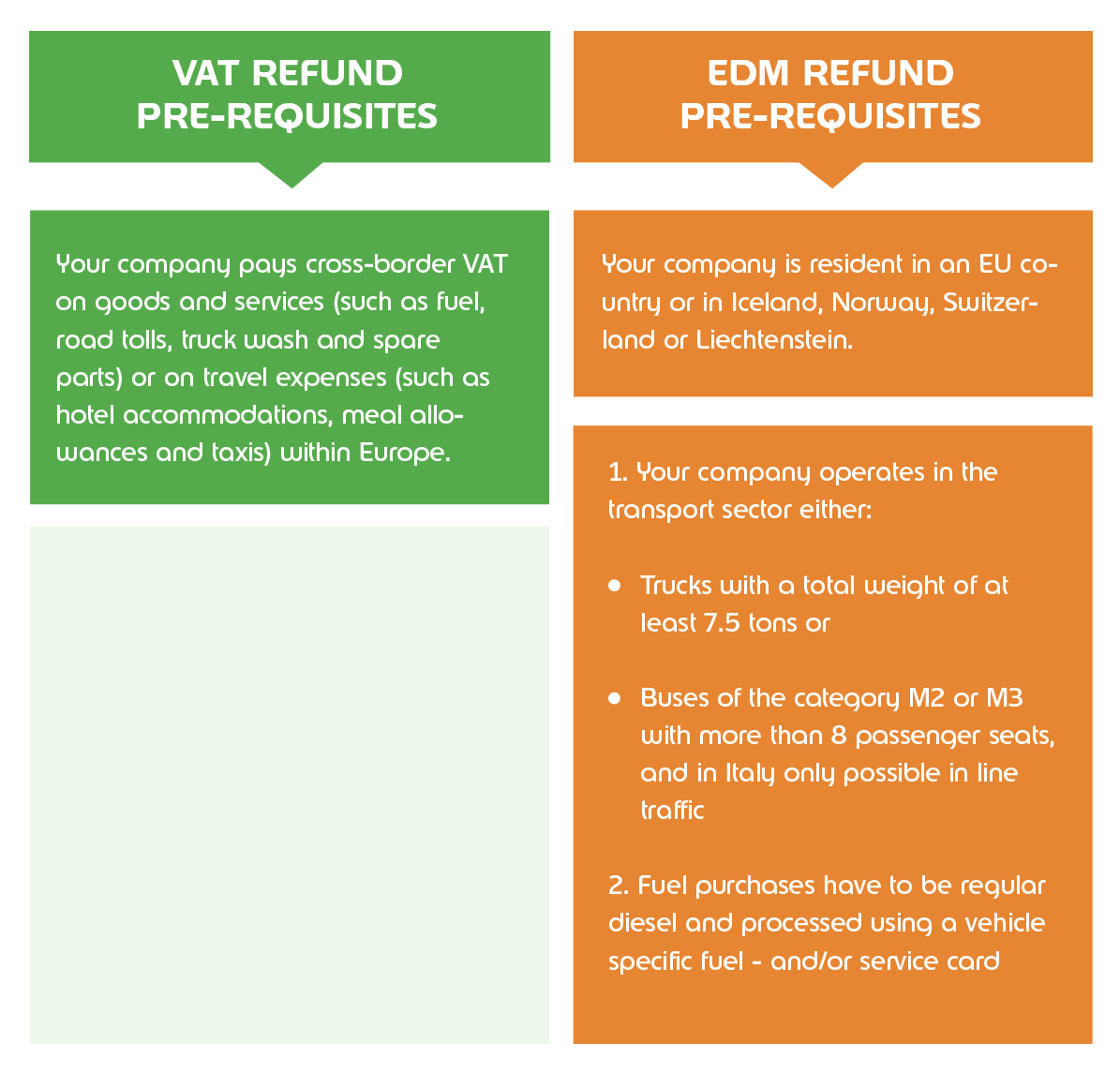

NIKOSAX makes it easy for your company to overcome all these challenges provided they meet a set of simple requirements per refund type.

Here are the general preliminary requirements for the 2 refund services offered by NIKOSAX.

*Note that further requirements exist after engaging NIKOSAX. We will assist your company to fulfil all additional requirements.

Order any of our refund services today and let NIKOSAX take over the administrative burden. Contact us!

References

Business Advice. (2017, Jan 19). Business Advice . (K. Clifford, Editor) Retrieved June 14, 2019, from businessadvice.co.uk: https://businessadvice.co.uk/tax: https://businessadvice.co.uk/tax-and-admin/year-end/seven-profit-draining-mistakes-to-avoid-in-2017/

InvestmentEurope.

(2015, February 04). The unclaimed tax billions: a cross border solution to a cross border problem . Retrieved June 15, 2019, from www.investmenteurope.net: https://www.investmenteurope.net/investmenteurope/opinion/3714881/unclaimed-tax-billions-cross-border-solution-cross-border

Your NIKOSAX Team